Overhead Rate Meaning, Formula, Calculations, Uses, Examples

Once a company has determined the overhead, it must establish how to allocate the cost. This allocation can come in the form of the traditional overhead allocation method or activity-based costing.. Added to these issues is the nature of establishing an overhead rate, which is often completed months before being applied to specific jobs. Establishing the overhead allocation rate first requires management to identify which expenses they consider manufacturing overhead and then to estimate the manufacturing overhead for the next year. Manufacturing overhead costs include all manufacturing costs except for direct materials and direct labor.

Determining the Predetermined Overhead Rate Formula

The overhead rate is a cost added on to the direct costs of production in order to more accurately assess the profitability of each product. In more complicated cases, a combination of several cost drivers may be used to approximate overhead costs. Predetermining is a process of working out the predetermined overhead rate by dividing the estimated amount of overhead by the estimated value of the base before actual production commences.

- For example, the office rent mentioned earlier can’t be directly linked to any one good or service produced by the business.

- Thus the organization gets a clear idea of the expenses allocated and the expected profits during the year.

- By understanding how to calculate this rate, business owners can better control their overhead costs and make more informed pricing decisions.

- Cost accountants want to be able to estimate and allocate overhead costs like rent, utilities, and property taxes to the production processes that use these expenses indirectly.

- The allocation base (also known as the activity base or activity driver) can differ depending on the nature of the costs involved.

- Fixed costs are those that remain the same even when production or sales volume changes.

- The production hasn’t taken place and is completely based on forecasts or previous accounting records, and the actual overheads incurred could turn out to be way different than the estimate.

Best Practices for Overhead Rate Management

- The third step is to compute the predetermined overhead rate by dividing the estimated total manufacturing overhead costs by the estimated total amount of cost driver or activity base.

- Sales of each product have been strong, and the total gross profit for each product is shown in Figure 6.7.

- The sales price, cost of each product, and resulting gross profit are shown in Figure 6.6.

- This means that for every hour of work the marketing agency performs, it will incur $20 in overhead costs.

- In this article, we will discuss the formula for predetermined overhead rate and how to calculate it.

- Therefore, this predetermined overhead rate of 250 is used in the pricing of the new product.

- Before the beginning of any accounting year, it is determined to estimate the level of activity and the amount of overhead required to allocate the same.

11 Financial may only transact business in those states in which it is registered, or qualifies what are retained earnings for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. This can result in abnormal losses as well and unexpected expenses being incurred.

Actual Overhead Rate

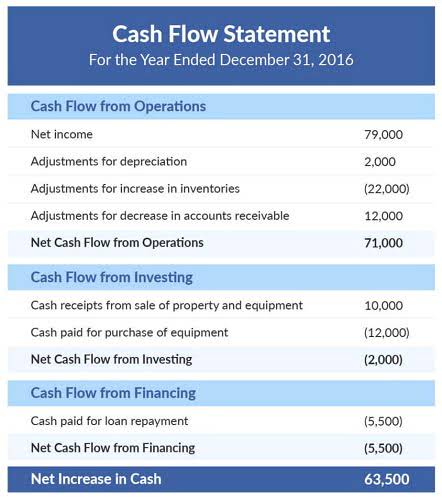

In summary, overhead rates have a sizable impact on a company’s key financial statements and decisions. Investing time into overhead analysis and accurate calculation of rates leads to better accounting and superior business management. To calculate their rate, the marketing agency will need to add up all of its estimated overhead costs for the upcoming year.

- Using the Solo product as an example, 150,000 units are sold at a price of $20 per unit resulting in sales of $3,000,000.

- One of the advantages of predetermined overhead rate is that it can help businesses monitor overhead rate.

- As you’ve learned, understanding the cost needed to manufacture a product is critical to making many management decisions (Figure 6.2).

- Different businesses have different ways of costing; some would use the single rate, others the multiple rates, while the rest may make use of activity-based costing.

Allocating overhead this way provides better visibility into how much overhead each department truly consumes. You’ll master the key formulas, learn how to allocate costs properly across departments, see real-world examples, and discover best practices to control overhead expenses. This means that for every hour of work the marketing agency performs, it will incur $20 in overhead costs. Company X and Company Y are competing to acquire a massive order as that will make them much recognized in the market, and also, the project is lucrative for both of them. After going to its terms and conditions of the bidding, it stated the bid would be based on the overhead rate percentage.

For these reasons, most companies use predetermined overhead rates rather than actual overhead rates in their cost accounting systems. As you’ve learned, understanding the cost needed to manufacture a product is critical to making many management decisions (Figure 6.2). Knowing the total and component costs of the product is necessary for price setting and for measuring the efficiency and effectiveness of the organization. Remember that product costs consist of direct materials, direct labor, and manufacturing overhead. A company’s manufacturing overhead costs are all costs other than direct material, direct labor, or selling and administrative costs.

Would you prefer to work with a financial professional remotely or in-person?

This is related to an activity rate which is a similar calculation used in Activity-based costing. A pre-determined overhead rate is normally the term when using a single, plant-wide https://www.bookstime.com/ base to calculate and apply overhead. Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Any difference between applied overhead and the amount of overhead actually incurred is called over- or under-applied overhead.

Example 2: Cost per Hour

A company that excels at monitoring and improving its overhead rate can improve its bottom line or profitability. One of the advantages of predetermined overhead rate is that it can help businesses monitor overhead rate. A business can calculate its actual costs periodically and then compare that to the predetermined overhead rate in order to monitor expenses throughout the year or see how on-target their original estimate was.

How to calculate a predetermined overhead rate

This $4 per DLH rate would then be used to apply overhead to production in the accounting period. The difference between actual and applied overhead is later assessed to determine over- or under-application of overhead. Additionally, you should recalculate your predetermined overhead rate any time there is a significant change in your business, such as the addition of new equipment or a change in your product line. The predetermined overhead rate business owner can then add the predetermined overhead costs to the cost of goods sold to arrive at a final price for the candles. Here’s how a service-based business, namely a marketing agency, might go about calculating its predetermined overhead rate. Hence, preliminary, company A could be the winner of the auction even though the labor hour used by company B is less, and units produced more only because its overhead rate is more than that of company A.